NEEM Publications

BLUEPRINT OF THE NEEM HUB CORE SOLUTION

ENGAGING FINANCIAL INSTITUTION CUSTOMERS AND SPURRING ACTION IN RENOVATING THE PRIVATE HOUSEHOLD SECTOR

The Nordic Energy Efficient Mortgage (NEEM) Hub is a regional part of the Energy Efficient Mortgage Initiative (EEMI) launched by the European Mortgage Federation in 2016. The goal of the EEMI is to assist mortgage lenders in Europe to fund energy renovations and provide green mortgage finance. To tackle the challenges of scaling up green mortgage lending, various solutions have been implemented under this initiative, such as the development of a common green mortgage label, the provision of material data flow for lending institutions, and market research.

The purpose of the NEEM Hub is to address the “energy efficiency gap” or “information gap,” which refers to the fact that many households in the Nordics could benefit financially from energy renovations but remain unaware of them or do not consider them. This is a significant challenge for the Nordic market because even if energy renovations become more attractive (e.g., through taxes and subsidies), households may not consider making them. Therefore, the hub’s primary objective is to develop a solution that informs households of their options and potential benefits from energy renovations.

This report will present the value chain for different solutions developed by the NEEM Hub to tackle the information gap.

NEEM CORE SOLUTION AT A GLANCE

The ultimate purpose of the solution is to identify, reach out to, and incentivise households where energy renovations would be beneficial, not only from a climate perspective but also from a financial perspective, where the savings in energy bills would surpass the costs entailed in such a renovation.

Our vision is to develop a solution that provides the following information to households:

Figure 1

A vision of the NEEM Core Solution

Source: Copenhagen Economics

Here is a concrete example of the message conveyed to a given household:

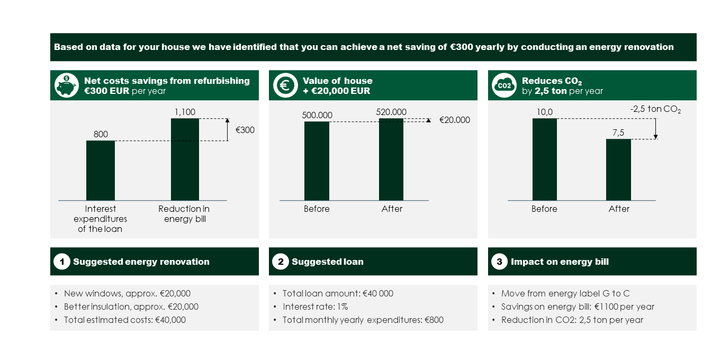

We have analysed data for your home and found that it could be beneficial for you to make an energy renovation.

- We estimate that your household currently has an energy performance certificate(EPC) label of G. An energy renovation could increase your energy efficiency to label C.

- We estimate that with such a renovation, you could save up to €1,100 per year on your energy bill.

- We estimate that the cost of such a renovation would be around €40,000. A loan to finance this would cost you around €800 per year, meaning that you would obtain net savings of €300 per year.

- At the same time, we estimate that your home will increase in value by around €20,000.

- Finally, the reduction in energy for a 130 m² house going from label G to C will save around 2.5 tons of CO2 per year, corresponding to driving 20,238 km in a car.

This information is summarised in a two-page document (‘two-pager’) that is sent to households, along with a call for action to contact an energy advisor or vendor.

Moreover, we wanted to provide recommendations, without households providing any information themselves. The reason is that once households are asked to enter personal information (e.g., report their energy bill or their number of windows), we would likely lose many potential customers. Also, our purpose is to create a solution where the bank can do some minimum screening of investment opportunities and hence address only households where existing available information suggests there might be a case for investing and providing financial gains for the customer without requiring the customer to provide any information.

In the following, we provide an overview of the value chain of solutions required to produce the two-pager; see also Figure 2.

Figure 2

Value chain of the NEEM Core Solution

Source: Copenhagen Economics

DATA FOUNDATION

We intended to provide tailor-made energy renovation advice to households without requiring them to provide us with their personal information. This presents a significant challenge in terms of data collection and has become a primary focus for our team.

Early in our work, we identified hourly energy consumption data as the key parameter for estimating a house’s energy efficiency. While these data should technically be accessible to households, obtaining them directly by asking the owners would likely drive away many households, excluding them from our analysis.

To address this, we established agreements with utility companies that could also provide us with the necessary data (after receiving consent from the households). By combining this with public information on building characteristics (e.g., size of the home and number of floors) and local weather data, we were able to estimate the energy efficiency of the respective households.

ESTIMATING ENERGY EFFICIENCY AND RENOVATION NEEDS

Our next step was to estimate the energy efficiency. If a new EPC label already existed for the household, this step would become unnecessary. However, a majority of households in the Nordics had no labels or only outdated ones. This is particularly true for older buildings, which typically require energy renovation.

To estimate energy efficiency, we developed a model that identifies correlations between energy consumption and weather conditions. The technical details of the model are described in the main report, but the basic premise is that we can identify signs of poor insulation or inadequate wind tightness by observing the impact of temperature and wind on energy consumption.

Once we have estimated energy efficiency for a particular household, we estimate the relevant energy renovation needed. To do this, we use Copenhagen Economics’ renovation costs model, which is based on correlations between increasing energy efficiency and renovation costs identified from 130,000 EPC label reports. We validated and modified these estimations, using empirical studies. By using these correlations, we can estimate the likely energy renovation costs for a specific household and identify the renovations that are most likely to provide the largest net savings for the household.

With these estimates in hand, we produced the two-pagers that provide households with the information they need to make informed decisions about energy renovation.

REACHING OUT TO HOUSEHOLDS AND COLLABORATION WITH VENDORS

The FI’s outreach strategy is based on the one-stop-shop concept, meaning that households are guided through a customer journey starting with a lack of awareness and ending with completed renovation.

A key instrument when reaching out to households is the two-pager, showing the results of the digital energy screening. However, the purpose of the two-pager, which the household receives when a potential for energy efficiency renovation exists, is not to provide a final answer on whether a renovation is a good idea or not. Rather, the purpose is to identify the cases where the house owner may wish to explore the opportunity and take further action to investigate the potential benefits. The estimates provided on the two-pager serve as a Call To Action (CTA), providing a clear picture of the potential savings that can be achieved through energy efficiency improvements.

To create credibility and increase information, the savings potential and the workings of the energy model are presented next. Concretely, we present the yearly savings potential in monetary terms, the CO2savings potential, the potential increase in energy label, and the estimated increase in house price when renovating.

The FIs have different options for how to introduce digital energy screening to households. One is simply to call a pre-screened sample of households and ask whether they would be interested in a free energy screening estimating the savings potential of their house. Another is to present the offer in a letter. The latter is effective and less resource demanding.

A crucial part of the customer journey is the choice of the collaboration partner. For FIs to become a successful one-stop-shop, efficient collaboration models with third parties such as energy advisors and installers are needed. The two main approaches are to team up with either commercial partners or objective energy advisors. The advantage of choosing a commercial partner is that the solution can be offered and installed by the same partner conducting the energy visit promoted by the two-pager. The advantage of an energy advisor is that more reliable and better solutions may be advised; however, the partner cannot carry out the solution themselves.

KEY LEARNINGS

In the main report, we present the value chain of the solutions in the NEEM Core Solution outlined above and discuss how we have overcome the obstacles encountered in this process. Below, we summarise three key learning points from the process:

- Agreements with utility companies are crucial. Obtaining energy consumption data is a game-changer in identifying and guiding households on energy renovations. Without this data, it is challenging to provide tailored advice to a specific household. Ideally, the data come directly from utility companies. While initiatives exist to make public data hubs available in the Nordic countries, GDPR concerns have made it difficult to use the data in a commercial setting like the NEEM Core Solution. Moreover, processing these data involves significant work since industry data often vary from company to company. Therefore, FIs may need to rely on third-party providers.

- Households are receptive.We have generally observed a strong appetite for households to have their energy efficiency tested. In a test conducted in Denmark, 39 out of 40 participants agreed to participate, and 32 gave us consent to obtain energy data through their online bank. Almost all of them found it relevant to be contacted with such information.

- There are uncertainties when choosing a partner to conduct the energy renovation.Once the two-pager with information on energy renovation is sent, a crucial next step is to introduce the household to someone who can implement the energy renovation. Here, two options exist, both of which may entail additional challenges:

- Introducing the household to an energy advisor:They would typically be able to conduct a 360-degree review of the home and consider all relevant energy renovations. However, such visits typically entail costs, and it is not clear who should cover them. If households had to pay, it would likely discourage many from engaging in the renovation. After the energy advisor finishes the visit, the household is left with the challenge of finding a vendor that can conduct the energy renovation.

- Introducing the household directly to a commercial vendor:This implies that the household would engage with someone who can carry out a renovation. However, a commercial vendor would typically not conduct a 360-degree review of the home and is potentially more interested in pushing the renovations that the vendor thinks are most profitable for themselves. This increases the risk that not all relevant renovations or the wrong ones are considered.

Although the NEEM Core Solution is a value chain of interlinked solutions, it should not be seen as a take-it-or-leave-it proposal. Rather, FIs can use parts of the solutions developed. The solutions can be seen as different but internally consistent ideas that can help FIs to expand their lending for energy renovations.

In addition, other obstacles to energy renovation are addressed in the work of the hub, for example, the perception of the high complexity of energy renovation, involving many actors, but where the household only has limited knowledge of the quality of the actors. These solutions are described in separate publications that can be found at NEEMHub.eu.

NEXT STEPS

The consortium members of the NEEM Hub have spent the past two years developing and testing the above solutions. The results of the NEEM project have confirmed that the NEEM Core Solution is a relevant and effective instrument in engaging FI customers and spurring action in renovating the private household sector. Among FIs, the project has succeeded in strengthening the efforts in the green agenda, and readiness to pursue actions that promote green solutions and green loans is now widespread.

There are several promising ways to build on the results and efforts of the NEEM Hub. In the NEEM Hub, tests were limited to certain geographical areas due to data constraints. By the end of 2023, data coverage will expand by factor 10+, meaning that FIs can target +100,000 households located close to the largest cities in Denmark. A natural next step for the NEEM Hub would be to use the increased data coverage and scale the efforts significantly.

In addition to continuing the work by scaling the efforts, refining and automating the NEEM Core Solution is needed. In the tests so far, the two-pagers have been produced manually. In further tests, this should be automated so that digital energy screenings are quickly and easily produced based on data input.

Another interesting topic to explore is optimising outreach channels. Having automatised value chains allows for reaching out to 200 or 2,000 clients. So far customers have been contacted by phone, which is not cost-efficient when reaching out to 2,000 clients. A fruitful next step could be to test alternative outreach approaches such as different versions of digital letters and webinars.

A final promising road to pursue is to assist FI and commercial partners in transferring the business model outside the Nordics. Both FIs and the commercial energy partners have stated their explicit interest in this. As the Nordics in some areas are quite far, e.g., when it comes to availability of data, this road may be the most interesting to pursue in terms of accelerating the green transition.

Authors

COPENHAGEN ECONOMICS

- Helge Sigurd Næss-Schmidt

- Jonas Bjarke Jensen

- Signe Rølmer Vejgaard

- Astrid Leth Nielsen

- Marco Islam

- Simone Ruth Flindhardt

BEHAVIOURAL ADVISORY

- Jossi Steen-Knudsen

GREEN DIGITAL FINANCE ALLIANCE

- Pietro Visetti

- Jannika Aalto

- Gerrit Sindermann

EMF-ECBC

- Jennifer Johnson

- Luca Bertalot

NORDEA

- Niklas Rydberg

- Jakob Skott Sigtenbjerg

SWEDBANK

- Daniel Pergeman

- Artin Shams

- Jesper Sjöholm

HEMMA

- Therese Ruth

- Martin Ekenbäck

DTU

- Justinas Smertinas

- Peder Bacher

CENTER DENMARK

- Søren Bernt Lindegaard

- Sandijs Vasilevskis